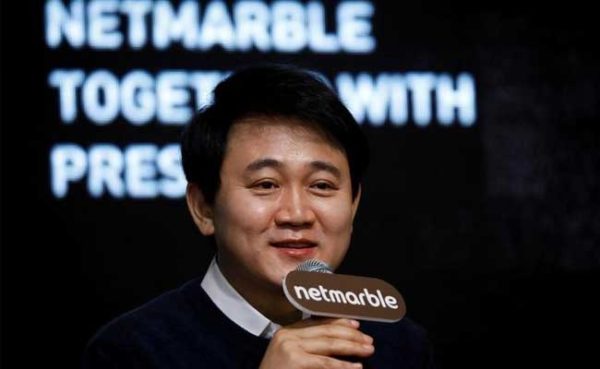

The man behind South Korea’s biggest initial public offering in seven years has charted an unlikely path in a country dominated by family-run conglomerates.

A high school dropout born in a textile factory slum, Bang Jun-hyuk has used a hard-charging attitude to grow Netmarble Games Corp. into a gaming giant, winning fans and critics along the way. Its shares debut Friday after an IPO that raised 2.66 trillion won ($2.3 billion) and values the company at about 13 trillion won, which is more than the market capitalization of LG Electronics Inc.

While chaebol such as Samsung and Hyundai have long focused on manufacturing, Bang bet early on the power of smartphones to drive gaming content, building the company he founded in 2000 with just eight employees into the publisher of Lineage 2 Revolution and MARVEL Future Fight. Along the way, Netmarble has won backing from Chinese giant Tencent Holdings Ltd., which invested $500 million in 2014, as well as the CJ conglomerate.

“His ability to seal partnerships with overseas internet behemoths such as Tencent is also key to Netmarble’s success,” said Anthea Lai, an analyst with Bloomberg Intelligence. “Bang definitely proved his market instincts and leadership skills by turning the company around.”

Bang owns 24.5 percent of Netmarble, which at the IPO price gives him a net worth of $2.9 billion, according to the Bloomberg Billionaires Index. The founder, Tencent and CJ E&M Corp. are the three biggest shareholders. Bang wasn’t available for an interview and the company declined to comment ahead of the listing.

As a publisher, rather than just a developer, Netmarble is involved in more stages of the game industry spanning advertising, marketing and distribution for titles built in-house and by third parties. With the cash raised from the IPO, it’s also on the hunt for deals.

Chief Executive Officer Kwon Young-sig last month said the listing could allow the Seoul-based company to seek an overseas acquisition of as much as 5 trillion won in coming years.

After selling its shares in the IPO at the top of the targeted range, Netmarble has a price-to-earnings ratio of more than 70. That’s well above most of its peers, with NCSoft Corp. trading at about 28 times earnings and Nexon Co. at about 45 times.

It also faces stiffening competition, with NCSoft releasing a role-playing series this year to directly challenge Lineage 2 Revolution.

“It remains to be seen if Netmarble is an attractive stock to invest in, given its above-peer IPO valuation in terms of price to 2016 earnings,” Lai said.

In a nation where the 10 biggest chaebol account for more than a quarter of all Korean business assets, the rise of a company like Netmarble with its 3,000 workers may mean that traditional ways of conducting business and measuring success are changing.

“Those who make simple market comparisons may underestimate the value of our company,” Bang said at a press conference in January. “But there are also those who view our company as highly valuable because of its competitiveness.”

The 48-year-old, who didn’t go to college, has been compared to Steve Jobs for the way he returned to the company and ignited growth after years away resulted in losses. While the Apple Inc. founder stayed in the tech world during his absence, Bang went in a completely different direction in 2006: buying a stake in a local coffee house chain.

Netmarble struggled while he was gone, with its games failing to attract users and losses reaching into the tens of millions of dollars. Bang returned in 2011, seeking to save what he called a sinking submarine and focused it on the boom in smartphones.

While the Jobs comparison is flattering, other nicknames haven’t been so kind, with some local media dubbing him “torturer” for driving employees hard. For years, software developers have called its building in the Guro district a “lighthouse” because its office stayed lit well after neighbors have gone to bed.

The 24-7 culture is a reflection of the founder, who has highlighted that hard work is what a man without ties to the rich, politically powerful, or a prestigious school has to do to make a splash in Asia’s fourth-largest economy.

With a motto of working “like your life depends on it,” Bang was subject to a national controversy when three workers died between July and November last year. None of the deaths had been ruled as affiliated with the company, according to Netmarble.

“The relentless pursuit of a bonanza from a successful game has driven rapid growth and all-or-nothing work ethic at Netmarble,” said Choi Min, an occupational environment physician, who cited an online survey of game developers. “While the squeeze on the employees isn’t the only thing that made the company so successful, the way it has managed them is not sustainable. Luckily Netmarble was quick to address the issues last year.”

Among the changes Netmarble made were to ban overnight updates, even if it means delaying a game launch, and granting holidays for overtime work. The company acknowledges that its workload was high in 2012 and 2013, when it was trying to ride out a crisis, but conditions improved after that.

Netmarble has been revving up hiring to ease the workload and overhauling its office culture to increase employee satisfaction as part of steps to become a global corporation, it said in an email.

The company has also been trying to soften its image, pointing out how much Bang values workers and that he once drove hours to convince an employee not to leave. After CJ E&M’s investment in 2004, Bang renamed Netmarble as CJ Internet to link it closer to the entertainment conglomerate, conscious that in South Korea there isn’t much cachet in the dating scene from working at a little-known startup.

The success of Netmarble’s IPO and Bang’s rags-to-riches story could well inspire a new generation of talent in a country where the dominance of chaebol has been accused of stifling innovation.

“The rise of Netmarble and its founder will likely encourage more IT startups in South Korea,” Bloomberg Intelligence’s Lai said. “Unlike sectors such as heavy industrials and hardware technology, in which South Korea already has a strong presence globally, software is less capital intensive and thus the entry barrier is lower.”

Leave a reply