India’s main stock index, the Sensex, has hit a record high, propelled by an increased inflow of foreign capital.

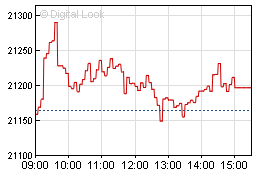

The index reached 21,293.88 early on Friday, surpassing its previous high of 21,206 set during the stock market boom of 2008, before closing at 21,196.81.

The rise marks a remarkable turn around from two months earlier, when foreign investors were pulling out money from the country amid worries over growth.

However, some analysts doubted whether the current rally was sustainable.

“I am not too pleased with the way fundamentals are shaping up,” said Phani Sekhar, a fund manager of portfolio management services at Angel Broking.

He added that the rally was being driven by only a handful of stocks “which are hopelessly expensive despite fundamentals”.

“The liquidity rush is making people accumulate stocks. If fundamentals don’t improve or liquidity tapers, then this rally won’t have many legs,” he said.

Rajan rally?

Investor confidence has also been boosted after the country’s new central bank chief, Raghuram Rajan, took charge in September and promised tough action to boost growth.

Mr Rajan has unveiled a series of measures aimed at propping up the currency and liberalising the country’s banking sector.

Since then, markets have risen strongly and the rupee has strengthened – after having dipped nearly 28% against the US dollar between May and August.

It has now recouped some of those losses, gaining 10% against the US dollar since the start of September.

The stock index has now risen nearly 19% since hitting this year’s lowest level in August, in what many have dubbed as the Rajan rally.

The Fed factor

Earlier this year, Indian stocks markets – like those in many other emerging markets – were also hurt by concerns that the US may scale back a key stimulus programme.

The US Federal Reserve has used the programme, known as quantitative easing, to increase the money supply and improve liquidity in the financial system.

A part of that increased liquidity flowed to emerging economies, especially in Asia, triggering a surge in stock and asset prices over the past few years.

As a result, fears that the Fed’s stimulus policies may be tapered off had resulted in high volatility in the markets.

But last month the Fed delayed its decision to wind down the programme.

Analysts say the decision has seen foreign investors put money back into emerging markets such as India.

“This rally has been fuelled by an avalanche of global liquidity into emerging markets, after the reprieve by the US Fed as far as the US tapering plan goes,” said Ajay Bodke, head investment strategist with Mumbai-based brokerage Prabhudas Lilladher.

Foreign funds pumped $2.55bn (£1.6bn) into Indian equities in October.

Leave a reply