After a long period of relative calm, investors have faced more volatile markets in recent months. In Q4 last year, the S&P 500 came within 63 basis points of a technical bear market, dropping -19.37% from a high of 2,930 in September to a Christmas Eve low of 2,351. Risk assets have since recovered ground, but with volatility likely to remain higher in 2019 and global growth slowing even in the US, should investors expect a recession in the next 12 months?

Analyzing US Macro Activity

To help answer this question and anticipate how the Federal Reserve may change monetary policy, we use a proprietary indicator that examines US macro activity. It is based on multiple metrics from various sectors of the US economy such as employment, housing, manufacturing as well as some financial market and survey data such as ISM PMIs. The activity metric gives us a timely and objective view of current growth trends.

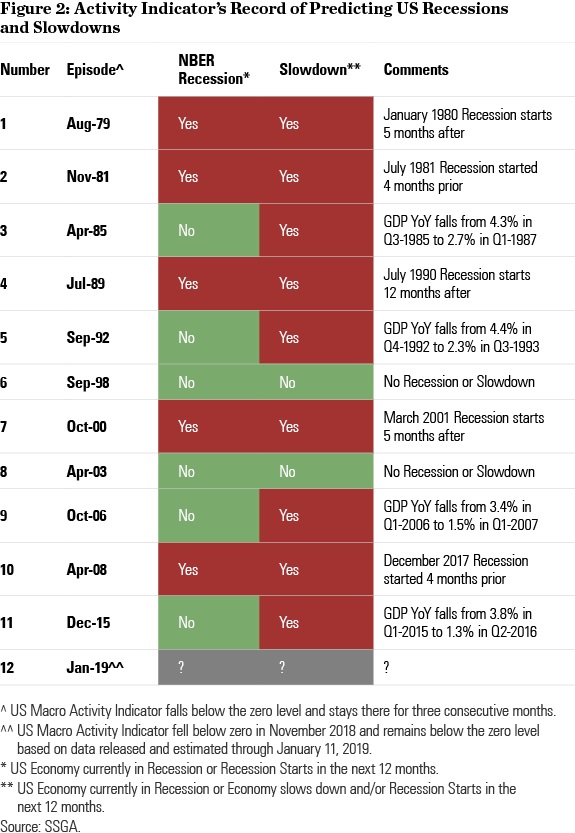

Figure 1 shows our US Macro Activity Indicator over the last 40 years against recession data (shaded areas) from the National Bureau of Economics Research (NBER). We also highlight the 12 episodes (including the current one) in which the Activity Indicator has fallen below zero and remained there for three or more consecutive months. (The Indicator has a tendency to stay negative for some time once it falls below zero.)

The most recent drop below zero has been driven by a combination of factors including the recent deterioration in manufacturing and housing data. (The latter has been a significant detractor for some time.) The significance of the Activity Indicator dropping below zero is that no US recession has taken place in the past four decades without that occurring. However, that does not mean a recession is imminent, only that it is more likely. Figure 2 summarizes our Activity Indicator’s track-record in predicting US recessions and slowdowns.

Recession Probabilities

In five out of the eleven past episodes, the US economy was either in a recession or entered one over the next 12 months after the Activity Indicator dropped below zero. This would put the current probability of a US recession over the next 12 months at about 45% (=5/11).

If we include slowdowns in our calculations, this increases the probability of a negative outcome. In all but two of the past 11 episodes, the US economy suffered a recession or slowed down over the subsequent 12 months. This would put the likelihood of a US recession or a slowdown over the next year at about 82% (=9/11).

It is important to note the relatively low statistical confidence we can assign to these empirical probabilities due to the relatively small size of the sample set. It is also important to recognize that two episodes (September 1998 and April 2003) were false negatives. In these instances, the activity metric recovered without the economy slowing down or entering a recession.

Getting Ahead of the Fed

While we cannot say with certainty whether a recession will occur in the US over the next 12 months, we think there is an increased likelihood of one through the lens of our Activity Indicator. So we believe it is worth watching for what it may tell us about the future of US economic growth.

It may also offer early clues as to which direction the Fed may take on interest rates and normalizing its balance sheet. Even as the Indicator tipped downwards in late 2018, the Fed became far more dovish in tone, hinting it may pause on further tightening. At present, we do not expect a further hike until June. Even then, it will need to be data dependent, meaning indicators of economic activity will be central to Fed thinking at this point in the cycle.

Disclosures

The views expressed in this material are the views of Orhan Imer through the period ended 01/30/2019 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investing involves risk including the risk of loss of principal.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

The information provided does not constitute investment advice and it should not be relied on as such. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

United States: State Street Global Advisors, 1 Iron Street, Boston, MA 02210-1641

Leave a reply