Introduction:- To What Is Bitcoin

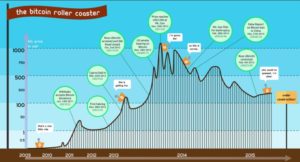

Are you curious about what Bitcoin is and its impact on the financial market? Today, Bitcoin stands as one of the most talked-about financial offerings, sparking debates about its authenticity, whether it’s a bubble or a genuine investment opportunity. Amidst these discussions, serious investors are exploring various avenues to get real value from this cryptocurrency. One such avenue gaining traction is utilizing a crypto trading bot similar to this one from https://immediate.net/es/, a tool that automates trading strategies and helps investors navigate the volatile crypto market. Despite the ongoing debates, the lack of public understanding and awareness about this product remains a key concern for potential investors.

Before we proceed any further in this cryptocurrency debate, it is important to understand what is bitcoin? A brief insight into the history of the product is crucial to understand its complete worth.

Defining Bitcoin.

One of the simplest answers to what is Bitcoin is that it is a cryptocurrency. It means it is nothing but chains of computer code with a monetary value. It is created based on the basic principles of cryptography. This is exactly why you would often come across the term, cryptocurrency. In fact, cryptography is used extensively even in terms of regulation and assigning a monetary value. Many experts also term it as a digital currency. Bitcoin that way is the first virtual currency. It was first introduced in 2009 and has taken the world by a storm since then.However, the origin of this currency is shrouded in secrecy. No one exactly knows who created it exactly and when. But, most accounts credit Japan’s Satoshi Nakamoto with the creation and use of this currency. We have not heard much about him after this but it is believed he left a Bitcoin fortune.

Today the Bitcoin legacy has moved by leaps and bound. We have a wide range of digital currency like Ethereum, Litecoin, Peercoin and many others. These are called Altcoins because the Bitcoin is still considered the original digital currency. Rest all are alternatives to it and in many ways follow the Bitcoin model.

But there is something unique about this original cryptocurrency, Bitcoin. It can be stored both online and offline. When the Bitcoin owners store the currency offline, on their individual hardware, it is called cold storage. However, you can also choose to keep it in hot storage, online, on the internet. However, the problem with hot storage is there is a much higher chance of the currency being stolen. Offline storage does not have that risk but if you lose access to the hardware, you lose the currency too. This is quite a significant risk, given that $30 billion worth bitcoin has been either lost or misplaced globally.

How Does Bitcoin Work?

Well, you have to accept that despite a number of Altcoins in circulation, Bitcoin remains the most popular one. This is exactly why it is interesting to understand how it works and how you can gain from it. In fact, it is the most important element of understanding what is Bitcoin.

Well, you have to accept that despite a number of Altcoins in circulation, Bitcoin remains the most popular one. This is exactly why it is interesting to understand how it works and how you can gain from it. In fact, it is the most important element of understanding what is Bitcoin.

Essentially this is a completely self-sufficient cryptocurrency that can function as smoothly as any other investment tool. You don’t need intermediaries like banks to either earn it or use this currency. Imagine trading in physical gold. Do you need any intermediary? You just trade it in exchange for money or other precious metals or stone. Well, you can do the same while trading with a Bitcoin. You can use it to buy different kinds of internet applications or simply store it like gold. You can even sell this currency at a significantly higher rate at a later date.

What’s even better as a first time user, you do not need very detailed technical knowledge about this currency either. You can start trading in it even with a basic understanding and small investment. The first step, in this regard, is often creating a Bitcoin wallet on your mobile phone or a computer. The moment you set up this wallet, it generates a Bitcoin address automatically. There is no limit on the number of Bitcoin addresses you create. You can also share this address with friends to pay each other and undertake retail transactions. This, in fact, is quite similar to how an email is created and sent. But the difference is you can use a Bitcoin address only once while your email id often becomes your identity.

As you broaden your scope about what is Bitcoin, there are some terms that you have a deal with quite often. These are not just the key to an effective transaction but also help you expand your technical understanding.

-

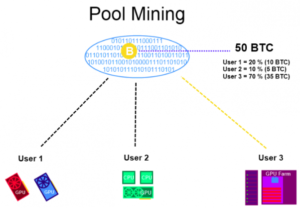

- Block Chain: This is perhaps the most important link in the global bitcoin network. It completely sidelines the roles of the intermediary like banks and connects consumers and suppliers directly. So, therefore, this is pretty much a digital ledger that keeps a record for all transactions globally. As the name blockchain indicates, this connects a chain of computers globally and these keep a tab of all transactions. So this becomes the digital bookkeeping unit.

- Transfer: This indicates a transaction using Bitcoin through individual wallets and a secret passcode. This private key makes sure that a third party can’t interfere with the transaction and helps maintain proof of genuine transfers. The user finally receives Bitcoin from the network through a process called mining.

- Mining: So what does mining Bitcoin means exactly. Well, in simple terms it is a system generated note confirming a transaction. Normally the transfer of Bitcoin takes about 10 minutes and this includes verification of the sender’s and the receiver’s identity. In many ways then, mining becomes a cool way to check misuse of this method of transaction. Most importantly this process rules out the possibility of individual interference. It makes sure that the entire transaction is undertaken in a pre-determined and automated fashion.

When you set out to understand what is Bitcoin, these terms helps you understand the chain of transactions clearly. Moreover, without a proper understanding of these key terms, you cannot comprehend the actual potential of the global bitcoin network. This process also improves transparency of the Bitcoin transactions. Users are able to gauge the:

- Viability of a trade

- Authenticate transactions

- Protect transactions

- Make sure a transaction is documented

- Confirm receipt of a transaction.

How To Buy Bitcoin?

You already know that you need a wallet to store your bitcoin. The point to consider now is how can you buy it? This is often the most striking concern in the race to own and trade Bitcoin and gain from them. Let’s say, I have a wallet in my mobile and I have the cash to spare but who do I connect with?

You already know that you need a wallet to store your bitcoin. The point to consider now is how can you buy it? This is often the most striking concern in the race to own and trade Bitcoin and gain from them. Let’s say, I have a wallet in my mobile and I have the cash to spare but who do I connect with?

Here again, I would like to use the gold example. Just like in case of gold, you can either approach the exchanges or buy directly from owners. As you probe deep into what is Bitcoin, you will find out it is quite simple to buy it and the range of options are quite extensive. From hard cash to credit cards and debit cards, there is a variety of means to buy Bitcoin including other cryptocurrencies.

In many ways how to buy a Bitcoin is also area specific. The place that you stay and the person you are buying from are very important. Well, your geographical location plays a crucial role in determining the mode of payment. Different countries have different payment regulation. Bitcoin transfer needs to conform to these rules at all times. Only then you will be able to undertake the transaction seamlessly.

For example, buying Bitcoin via credit card or payment wallets like PayPal is quite difficult in many countries in the world. Often the Government’s stand with respect to Bitcoin is a key factor. You have to be clear about the legal status of Bitcoin in your region. Is it allowed, are these transactions considered illegal or do you need to conform to some special regulations? All of these factors play a crucial role in determining the ways to acquire Bitcoin.

How To Exchanges & Wallets Operate?

The next step in your introduction to what is bitcoin, is how these exchanges and wallets operate? For newcomers, it can be actually confusing because there are many exchanges and wallets competing for your attention. The question is how can you choose the best option for you?

The next step in your introduction to what is bitcoin, is how these exchanges and wallets operate? For newcomers, it can be actually confusing because there are many exchanges and wallets competing for your attention. The question is how can you choose the best option for you?

There are some that operate as full-fledged exchanges but there are many others with limited capacity. This means the buying and selling alternatives in these are limited. However, in terms of operational details, most are similar to a bank account and can all store a certain minimum amount of currency for you.

But you should consider either of these only if you are interested in serious Bitcoin trading. They normally have a lengthy authentication procedure. You have to provide identity proof, maintain a contact list and provide proof of address.

This is part of the basic KYC regulations governing global financial system and many large bitcoin exchanges world over follow these norms. You can choose an appropriate one based on where you stay and how much money you would want to invest in. Different exchanges have a different degree of proficiency.

Some of the largest and full-time Bitcoin exchanges are currently operating in

•Hong Kong

•US

•China

•UK

•India

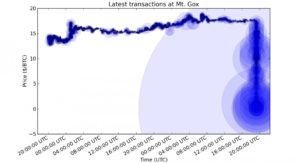

Each one provides a completely different set of rules and the local country specifications play a crucial role. Also the status of your citizenship in the country you are operating is extremely important. But you must remember one basic factor, despite the large list of regulatory norms, these exchanges are not as safe as banks. They never provide the protection that you get from banks. If the exchange is hacked or it shuts down, you have no insurance for your savings.

Moreover, in most countries, Bitcoin is still illegal so these exchanges do not have government support, either. This is the reason that Bitcoin theft is also quite high. I already mentioned that till date nearly $30 billion worth bitcoin has been misplaced or lost. Another important reason for it is a lapse of a password. If you have forgotten or let a password lapse, there is no guarantee of recovering the fund in future.

Also exchanging them for money or hard cash can be a challenge at times. Due to the regulatory uncertainties, banks sometimes refuse to deal with them. As a result of this, your fund might remain blocked. You might not be able to use the money when you need it. Therefore, it is always better to go for exchanges or wallets that are bank friendly and can be liquidated easily. This will make sure that you can get cash whenever you need just like in case of hard cash. This means you can use this investment to tide over difficult times when the need arises.

Is It Worthwhile To Invest In Bitcoin?

When you begin to understand the various nuances of what is Bitcoin, one important question is its viability. Is it worthwhile to invest in Bitcoin? Why should you use it? Does it make sense to park your savings in this investment tool? The questions are endless. But it also highlights the need to grasp the various aspects of ‘what is Bitcoin.’

When you begin to understand the various nuances of what is Bitcoin, one important question is its viability. Is it worthwhile to invest in Bitcoin? Why should you use it? Does it make sense to park your savings in this investment tool? The questions are endless. But it also highlights the need to grasp the various aspects of ‘what is Bitcoin.’

A close study would reveal that there are many advantages of trading in Bitcoin. As an individual and a group, the Bitcoin often has some distinct advantages over conventional currency.

- Inexpensive transaction: This is by far the cheapest way to transact money. Whether you consider net banking, credit card transactions or any other means, they all involve charges. The customer has to pay an additional amount for availing a different kind of online facility and frills. But this cryptocurrency offers an inexpensive alternative. Most Bitcoin transactions are free and even you have a transaction fee, it is rather small. This means that you can easily cut down on transaction expenses that you need to shell out. So it is a quick means to multiply savings and save money in the bargain as well.

- Fast Delivery: The other most important factor is the pace of these transactions. Even in case of internet banking, it is normally a few hours before you get the money. In many cases, it could even take days for inter-bank money transfers to reflect in your account. Now think of how fast Bitcoin transactions happen. Normally it is instantaneous. In case, merchants confirm the payments, it takes about 10 minutes. So you can actually get the money in hand in under 30 minutes. The comparison is out there for you. It is never difficult to judge the viability, especially in terms of speed.

- No Government Role: Whether you invest in banks or any other tool of investment, most operate within a strict regulatory framework. The Government plays a crucial role in some way and in times of financial crisis, they can even freeze your savings. But the realities change completely when you take Bitcoins into consideration. In most countries, it is completely out of the Government ambit and they don’t have any right to interfere with their operations. This means that the Bitcoin is completely out of the purview of the conventional economic cycle. This digital currency is completely market operated and its worth is decided by the market players. The Government cannot tinker with its valuations either. The market forces help determine the value of this currency.

- No Way To Reverse Payment: Transparency is one of the most important factors that many people are drawn towards Bitcoin. When you probe into what is Bitcoin, you will realise that the best part is you can’t reverse a payment. This means if you want to commit a payment fraud, this is not the best medium to try it out. Unlike in case of credit cards, there is no way to reverse the payment. But we have heard many instances of credit card transactions where the bank gets information to reverse payment. So the person who is going to receive the money can safely wait for the transfer of funds. Once the money has changed hands, there is no way to cancel it in any way. The person has to honour the payment already made at all costs.

- No Information Trade: This is perhaps one of the biggest concerns with regards to bank and credit card transactions. The threat of your information being leaked is quite real. Quite often you get calls from irrelevant telemarketers wooing you for a variety of product. Have you ever wondered where do they get your number from? Well, the data is leaked most times from all these pubic information hubs like banks and revenue department. But in case of Bitcoin transactions, your secret account related information cannot be stolen in any way. Unlike lengthy bank forms that can be bugged online, your Bitcoin transaction is both swift and safe online. If you are tired or worried about information theft, shifting to the Bitcoin economy could be an easy alternative to curb it.

You need to use only two keys to authenticate your Bitcoin transactions and no secret information is revealed in this case. You need to simply use a combination of your public and private keys to transfer the transactions.

Why Are Bitcoin Transactions Controversial?

Therefore, the question is why are Bitcoin transactions controversial? They decidedly have some distinct advantages over other conventional tools. Yet there are a lot of concerns surrounding them. In many countries, it is still considered illegal and there is no validity for these transactions. So it becomes an integral part of our study of what is Bitcoin.

Therefore, the question is why are Bitcoin transactions controversial? They decidedly have some distinct advantages over other conventional tools. Yet there are a lot of concerns surrounding them. In many countries, it is still considered illegal and there is no validity for these transactions. So it becomes an integral part of our study of what is Bitcoin.

- Limited Consumer Protection: One of the biggest concerns is the limited regulatory support. In case of losses, there is no way to shield consumers from losing their investment. If a bank goes bankrupt, the government pledges to return all its consumer’s money but there is no safety system in place to protect Bitcoin consumer’s interest. More importantly, consumers have no way of stopping theft or loss of Bitcoin. Supposing you have lost your password or it gets stolen, you cannot retrieve it in any way. This means your entire savings can get wiped out in a matter of minutes. You cannot file a complaint to any authority nor can you seek redressal. Therefore, it is surely not for the weak-hearted. If you do not have the additional cash or adequate risk appetite, you should not invest in this investment tool.

- Regulatory Uncertainty: There are many regulatory uncertainties involving Bitcoin. Most countries in the world brand it illegal and there is no way to undertake these transactions in a structured fashion. There are some countries like the United States where investors have to follow a series of restrictions to successfully execute this trade. This has often led to a wide range of speculation and uncertainty regarding the currency. As a result, many people are unsure about investing in this cryptocurrency and realising gains from it.

- Resource Heavy: Bitcoin transactions run as per water-tight cryptography norms. Most times, the blockchain downloads the entire chain of transactions globally on to your system. This means that your computers need to have that much of space to facilitate these downloads. So it needs really huge resources for the system to operate in a seamless fashion. There is a fear that if the Bitcoin network continues to grow at current pace, it can soon become unmanageable. You have to understand that currently, only one-tenth of the potential bitcoin network is operational. It can even lead to severe storage crunch going forward. As a result, there is also a cap on the total number of transactions on an hourly basis. This can severely impair the efficiency.

Conclusion

Therefore, you can conclude that Bitcoin transactions are both the best and worst reflection of modern times. While they truly reflect the technological advances, they are also an epitome of current challenges. As a beginner trying to understand what is Bitcoin, it is best to have a limited exposure. This will ensure that you do not book huge losses at any point of time. However, the lack of regulatory and the Government support is one of the biggest disadvantages for this virtual currency. The problem of the limited acceptance is also another big roadblock. It somehow always keeps the bias towards risk a lot higher while trading in Bitcoin.

Therefore, you can conclude that Bitcoin transactions are both the best and worst reflection of modern times. While they truly reflect the technological advances, they are also an epitome of current challenges. As a beginner trying to understand what is Bitcoin, it is best to have a limited exposure. This will ensure that you do not book huge losses at any point of time. However, the lack of regulatory and the Government support is one of the biggest disadvantages for this virtual currency. The problem of the limited acceptance is also another big roadblock. It somehow always keeps the bias towards risk a lot higher while trading in Bitcoin.

Leave a reply